The total construction demand (value of construction contracts to be awarded) in Singapore is expected to range between S$26 and S$31 billion in 2018, higher than the preliminary estimate of S$24.5 billion in 2017, according to the Building and Construction Authority (BCA).

The forecast was announced today (11 January) at the BCA-REDAS Built Environment and Property Prospects Seminar 2018.

The projected higher construction demand is due to an anticipated increase in public sector construction demand, which is expected to grow from S$15.5 billion in 2017 to between S$16 and S$19 billion in 2018. This contributes to about 60 percent of 2018’s total projected demand, said BCA.

The private sector’s construction demand is also expected to improve from S$9 billion in 2017 to between S$10 and S$12 billion in 2018, thanks to a strengthened overall economic outlook and the upturn in property market sentiment.

BCA highlighted the projects that are slated to be awarded this year, including:

1. Residential projects - a steady pipeline of new public housing construction, upgrading works for HDB flats, and a number of upcoming sizeable condominium projects earmarked for development at Shunfu Road, Stirling Road, Hougang Avenue 7 and Upper Serangoon Road;

2. Commercial projects - major upcoming office building projects planned for development are likely at locations such as Central Boulevard and Harbour Drive.

3. Industrial projects - an automotive hub at Jalan Terusan and a multi-storey recycling facility in northern Singapore.

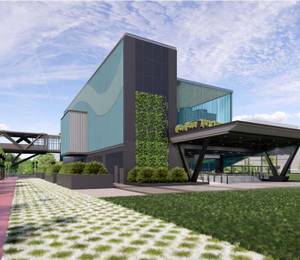

4. Institutional and other building projects - more healthcare facilities including the redevelopment of National Skin Centre at Mandalay Road and Woodlands Integrated Health Campus, various educational facilities for Institutes of Higher Learning (IHL), as well as private sector investments in developing nature based attractions and recreational facilities for tourists at Mandai Park.

5. Civil engineering projects - major contracts for the North-South Corridor, new MRT works and Deep Tunnel Sewerage System (DTSS) phase 2, as well as rolling out of the remaining package for Runway 3 by Changi Airport Group.

Furthermore, projects prescribing Design for Manufacturing and Assembly (DfMA) technologies have also become more prevalent in recent years, added BCA. The number of DfMA projects to be put up for tender is expected to increase in 2019 as more of such projects are firmed up.

Forecast for 2019 to 2022

BCA anticipates a steady improvement in construction demand over the medium term. It is projected to reach between S$26 and S$33 billion per annum for 2019 and 2020 and could pick up to between S$28 and $35 billion per annum for 2021 and 2022.

The public sector will continue to lead demand and is expected to contribute S$16 billion to $20 billion per annum in 2019 to 2022, said BCA, with similar proportions of demand coming from building projects and civil engineering works.

Besides public housing developments and healthcare and educational facilities, public sector construction demand over the medium-term will continue to be supported by major infrastructure projects, which include various developments for Changi Airport Terminal 5 and land transport projects such as the Cross Island Line, Jurong Regional Line, Rapid Transit System and High Speed Rail.

In addition, BCA expects private sector construction demand to also increase gradually in the medium term, boosted by the redevelopment of en-bloc sale sites and the spill-over benefits generated by the improved performance and outlook in other economic sectors.

The longer version of this story will be published in the Mar/Apr 2018 issue of Southeast Asia Construction.